Last updated on June 24th, 2021 at 12:45 pm

The “delayed exchange” or “forward exchange” is the most common type of 1031 exchange. When real estate investors or tax specialists refer to a 1031 exchange, they are usually talking about this type of exchange.

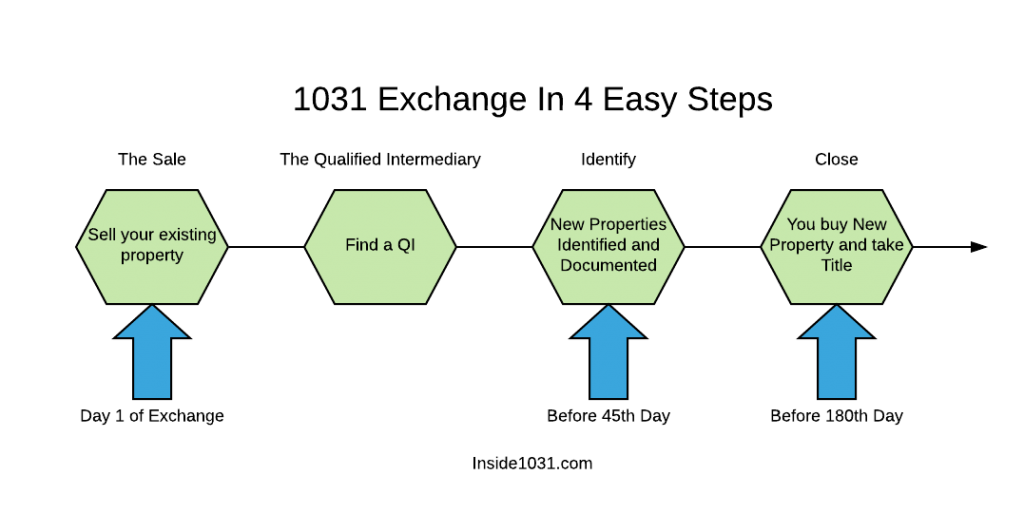

A delayed exchange allows you to sell an existing investment property and defer paying taxes. The rules are simple: You must identify new replacement properties within 45-days, and close on your new property within 180-days. The value of the new property must be equal or greater than the equity you held in your old property. If the value is less than your old property, this is “boot” and subject to taxes. A qualified intermediary must advise you throughout the process, and they will handle paperwork and IRS filings.

Sound easier than others have made it out to be? It is! While you shouldn’t go it alone, this article outlines the four steps that need to happen.

Table of Contents

Delayed Exchange Sale of Existing Property

The first part of a delayed exchange is the sale of your existing property. In order to do any type of 1031 exchange, it must be an investment property or used for business purposes. This could be an apartment complex, a warehouse, or even land that holds mineral rights. For the purposes of the rest of this article, let’s assume you own a duplex in your city.

You’re looking to sell your duplex in the next 6-12 months. You’ve owned it for 10 years, your city’s property values have gone up, and you want to buy in a different area. The process of selling this duplex is the same as it would be normally. You list the property, interested parties start discussions, and you eventually go under contract. Once you’re under contract and plan a closing date, you should find a reputable qualified intermediary (QI).

Qualified Intermediary for Your Delayed Exchange

The QI will help you plan the logistics of the delayed exchange. Choosing a QI is no small task. You’ll likely be recommended one by your title company or broker. One of the rules is that your QI cannot be a related party. Because of this, you’ll want to choose a QI that is not a family member, and you can prove you don’t have a business relationship with. Once you’ve chosen a QI, you’ll enter into an exchange agreement. This permits them to become the “substitute seller” in your place.

Exchange agreements can vary across different 1031 exchange companies, but they usually cover:

- An assignment of your contract to buy and sell real estate to the QI

- When closing, the QI will receive your proceeds from the sale

- A timeline that you must identify new properties within 45-days and close within 180-days

- Assign the QI the right to purchase the new property on your behalf

- When closing, the QI will use your funds and directly deed the property to you

Identify the New Properties

Once your old property is sold and you’re with a QI, the identification period begins. The IRS says you must identify potential replacement properties within 45-days, and close on one within 180-days.

The initial 45-day identification period causes the most confusion. Here’s the cliff’s notes: The 45-day clock starts when the old property is transferred to the new owner. If there are multiple properties being sold, the clocks starts when the first is sold. Additionally, the notification must be delivered by written document to the QI and signed by you. It must include a clear description of the property. This means a legal description, parcel or lot number, street address, and any blueprints. Your qualified intermediary will ask you for this legal description. They will keep track of this in case there are issues with the IRS. Last, there are rules about how many properties you can identify and their value.

The Three Property Rule

If you limit the number of identified properties to three, they can be any value you want. This can be tricky for investors because due diligence can find issues in many properties. Most investors identify more than three properties, which is governed by the 200% rule.

The 200% Rule

Under this rule, you can identify as many properties as you want, as long as their combined value is not greater than 200% of your old property sale price.

For example, if you sell a duplex for $200,000 you can identify up to three properties that are worth as much as you want, even millions of dollars. But if you identify a fourth, or more than four, their combined value can only be double your old property sale price. For example, if you sell that same $200,000 duplex, you can identify up to five properties for $40,000 each. Or ten properties that are $20,000 each. The IRS cares about this a lot. If you’re over by even a dollar, the entire exchange will fail.

The 95% Rule

This rule is not used often. It says that if you ignore both the three-property rule and the 200% rule, you must acquire at least 95% of the property you identify. For example, you sell a $200,000 property and identify four properties worth a combined $2.5M. Since you are above the 200% rule, the 95% rule says you must purchase all four properties for at least $2.375M. This rule is only used in commercial 1031 exchanges, and even then it’s not common.

180-Day Timeline to Purchase Your Replacement Property

Last is the purchase of your new, replacement property within 180 days. The clock continues from your identification period that began on the exchange date of the first property. Although not required, most QI’s recommend you are under contract with one of the identified properties within the 45-day timeline. If more than 45 days have passed and none of the previously identified properties are still pursued, the exchange will fail. Under these scenarios, the exchange agreement with the QI is cancelled, and your funds are returned. Worst, you have to pay taxes!

Assuming you are moving toward a sale by the 45-day identification period, the next timeline is the 180-day receipt. This says the replacement property must be received less than 180-days from the transfer of the old property. Also, the new property must be substantially similar to the identified property.

Two things to watch out for: 1. There’s no extension of the 180 days for any bad things that happen to you, the seller, or the QI during the closing process. There is an exception for natural disasters or emergencies. 2. The 180-day rule is shortened to when your taxes are due, unless you extend. For example, if your 180 days is up May 31st, you need to complete the exchange with your taxes by April 15. Otherwise, you’ll need to get an extension on your taxes.